Why Video Telematics Makes Fleets Safer to Insure

Insurers have always looked for signals that separate high-risk from low-risk clients and accurately assessing risk is paramount. For fleet insurers, the traditional metrics are evolving, and a new, powerful differentiator is emerging: fleets equipped with advanced video telematics, assessing risk based on actual behavior, near-misses, safety interventions, and even driver fatigue.

And it’s working.

The Data Speaks: Video Telematics Reduces Accidents

Fleets that invest in video telematics consistently see fewer accidents. When drivers know they’re being monitored, and coached in real time, they tend to avoid risky behaviors like phone use, tailgating, or speeding. Unlike traditional dashcams that merely record incidents for post-event analysis, AI-powered systems are proactive safety coaches in the cab.

- Real-time Risk Detection: AI algorithms instantly identify dangerous driving, including distraction, harsh braking, rapid acceleration, and tailgating.

- In-Cab Alerts & Coaching: Drivers receive immediate alerts for on-the-spot correction, building safer habits.

- Targeted Driver Training: Fleet managers use data insights to pinpoint areas for improvement and deliver customized training.

- Positive Reinforcement: AI telematics also commend safe driving, nurturing a positive and accountable fleet culture.

This kind of proactive safety has a ripple effect. Fewer accidents mean fewer claims. Fewer claims mean lower loss ratios. And for insurers, that translates to better margins and more predictable policy performance.

Clear Evidence, Faster Claims

When an incident does occur, AI dashcams become an insurer’s best friend, streamlining the claims process and ensuring fair outcomes.

This speeds up claims resolution significantly and helps reduce fraudulent claims. For insurers, that means:

- Irrefutable Evidence: High-definition video from all angles provides objective, undeniable proof of incidents, removing all ambiguity.

- Swift Exoneration: Clear video quickly proves a fleet driver’s innocence, protecting against false claims and cutting insurer payouts and legal costs.

- Accelerated Investigation: Adjusters can quickly review video, drastically reducing investigation time for faster claims and better efficiency.

- Reduced Fraud: The presence of AI dashcams acts as a strong deterrent against fraudulent and exaggerated claims, protecting an insurer’s financial stability.

Managing Risk Before It Becomes a Claim

AI-driven telematics platforms don’t just record incidentsת they help prevent them. Advanced systems monitor driver fatigue, distraction, speeding, harsh braking, and phone use in real time. This allows fleets to intervene early, coach drivers effectively, and build a culture of accountability.

From an insurer’s perspective, these are the kinds of clients you want:

- They care about risk reduction

- They invest in safety

- They actively work to lower their exposure

It’s a major shift from passively reacting to accidents to actively working to prevent them.

By recognizing and incentivizing fleets that adopt AI dashcams, insurers aren’t just mitigating risk; they’re investing in a future where roads are safer, claims are resolved efficiently, and partnerships are built on transparency and shared commitment to safety.

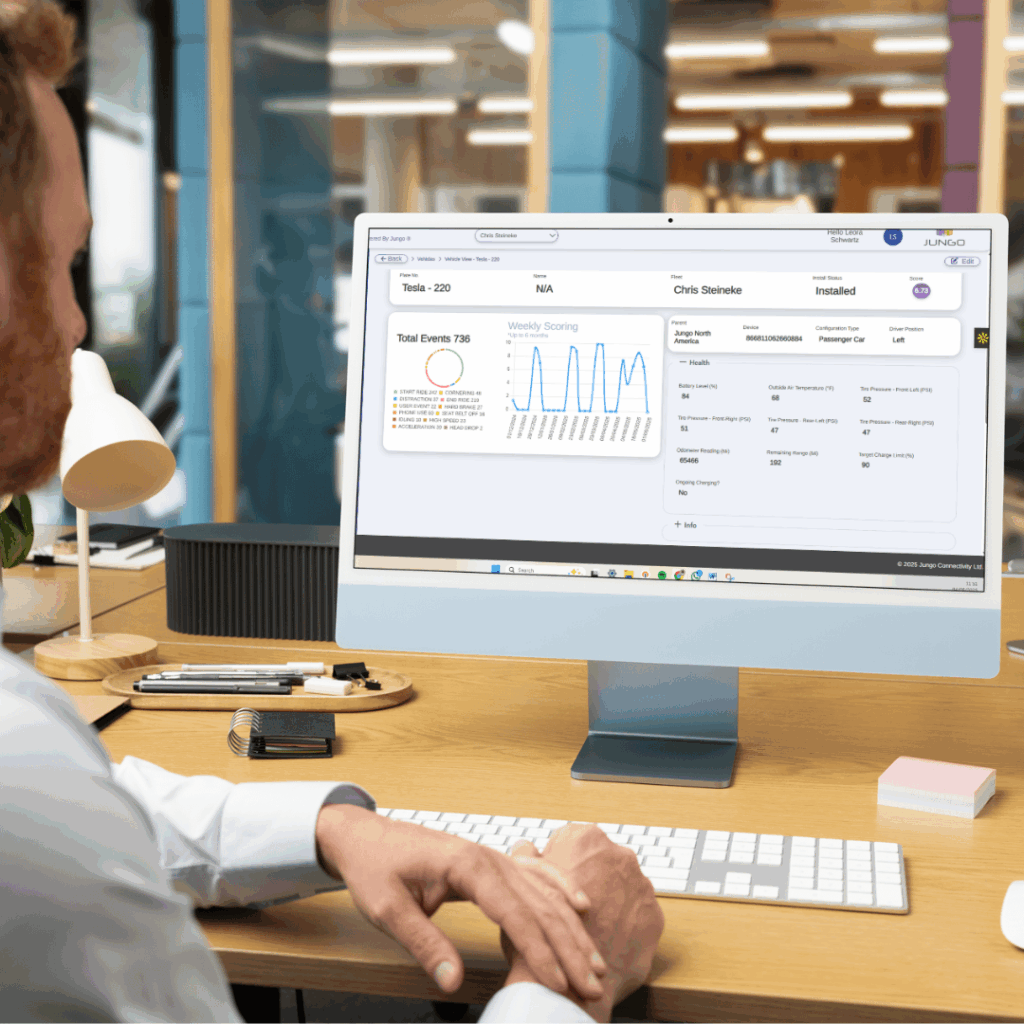

VuDrive: Making Safer Fleets Easier to Insure

VuDrive was built with insurers in mind. It combines a dual-facing AI dashcam, real-time safety alerts, and detailed driver scoring in a single, plug-and-play device. The system flags risky behavior like phone use and drowsiness, and gives insurers access to supporting video and telematics data when incidents occur.

The result: fewer accidents, faster claims, and better insight into fleet risk.

If you’re an insurer looking to work with safer, more transparent fleets, or a fleet operator who wants to become one, VuDrive is a smart place to start.

Learn more at https://jungo.com/fleet-insurance-telematics/