Video Telematics – Bridging the Gap Between Fleets and Insurers

What is Telematics?

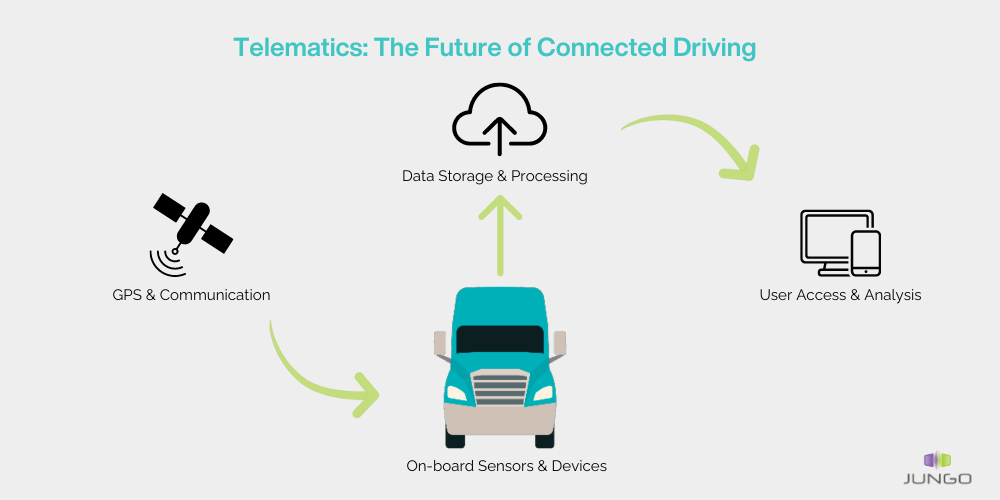

It is the technology used to monitor and manage vehicles remotely, combining telecommunications and informatics. Telematics involves the use of devices in vehicles that gather data, such as GPS tracking, monitoring driver behavior, and assessing vehicle health. It then transmits this data to a centralized system or platform. This data can be accessed in real-time or stored for later analysis.

Video telematics combines video footage and vehicle data to monitor and improve the way fleets operate. It uses cameras and sensors to collect real-time information on driving behavior, vehicle location, and road conditions. This data helps in enhancing safety, optimizing fleet operations, and providing visual evidence for insurance claims, making it a valuable tool for fleet management and operational efficiency.

The fleet industry is quickly recognizing the potential of telematics for multiple reasons. For fleet managers, telematics offers in-depth insights into vehicle operations, enabling optimized route planning, better fuel consumption, and enhanced safety measures. By monitoring driver behaviors such as speed, braking patterns, and driver behavior, managers can ensure compliance with safety standards, reduce operational costs, and improve overall fleet efficiency.

Telematics assist insurance firms in expediting claim processes by offering precise accident data, reducing false claims, and ensuring that claims are settled based on factual evidence. The growing importance of telematics in both the fleet and insurance sectors is undeniable. As technology continues to advance, the incorporating telematics is set to further enhance partnerships between these sectors, elevating efficiency, safety, and cost-effectiveness to unprecedented levels.

Video Telematics Transforming Fleet Management

Video telematics has revolutionized the way fleet managers operate and oversee their vehicle fleets. Here are some of the key benefits that telematics brings to fleet management:

- Enhanced Safety and Driver Behavior Monitoring: Video telematics systems enable real-time monitoring of driver behavior, including speeding, harsh braking, and distracted driving. By identifying risky behaviors, fleet managers can implement targeted training programs, promote safer driving practices, and reduce the likelihood of accidents.

- Improved Efficiency and Cost Savings: Through the analysis of video and vehicle data, fleet managers can optimize routes, reduce fuel consumption, and plan more effective maintenance schedules. This leads to significant cost savings and increased operational efficiency across the fleet.

- Streamlined Incident Analysis and Claims Process: In the event of an incident, video telematics provides irrefutable evidence of the circumstances leading up to, during, and after the event. This clarity speeds up the claims process, aids in exoneration in wrongful claims, and ensures more accurate liability assessment, transforming how incidents are managed and resolved.

Learn how AI dashcams cam empower fleet drivers

Insurance companies are increasingly recognizing the value of telematics and how it can enhance their business processes. Here are some key benefits they’re capitalizing on:

- Tailored Premiums: With telematics, it’s not about “one size fits all.” Insurers can set premiums based on actual driving habits. Safe driver? Expect some cool discounts!

- Quick Claim Processing: Had an accident? Telematics provides real-time data, making claim verifications a breeze. No more lengthy waits or heaps of paperwork.

- Fraud Prevention: Telematics is like a truth serum for claims. It’s harder for folks to make false claims when there’s data-backed evidence.

- Engaged Customers: Offering rewards or discounts based on telematics data? That’s a surefire way to keep customers engaged and loyal.

- Risk Management: With insights into driving patterns, insurers can identify high-risk behaviors and offer training or incentives to promote safer driving.

- Future Forecasting: Telematics data is a goldmine for predicting future trends, helping insurers stay ahead of the curve.

The Collaborative Power of Telematics

Telematics is opening up exciting collaboration avenues, especially for fleet managers and insurance companies. Here are some possibilities:

- Data Sharing: Telematics allows for the seamless exchange of real-time data between fleets and insurers. This mutual access to data ensures that both parties are on the same page, leading to more informed decisions and tailored insurance offerings.

- Joint Safety Initiatives: With insights from telematics, fleets and insurers can jointly develop safety campaigns or training programs. By addressing risky driving behaviors identified through telematics, these initiatives can significantly reduce accident rates and associated costs.

- Feedback Loop: Telematics provides a continuous stream of data, enabling both fleets and insurers to regularly assess and refine their operations and offerings.

- Cost Savings: Telematics-driven collaborations can result in notable cost reductions. For example, insurers can offer discounted premiums to fleets that demonstrate safe driving behaviors, leading to mutual financial benefits.

- Enhanced Customer Experience: For insurance companies, telematics data can be used to provide more transparent and personalized services to fleet clients. On the other hand, fleets can benefit from faster claim processing and more accurate premium assessments.

How Will Video Telematics Revolutionize Fleet-Insurance?

The fusion of video telematics with fleet management and insurance is not just a passing trend; it’s the dawn of a new era. As we look ahead, the role of telematics in shaping the future of fleet-insurance collaborations is undeniable.

Data collected by telematics devices will become increasingly sophisticated. This will allow for deeper insights into driving behaviors, vehicle health, and environmental factors. Advanced analytics will enable insurance companies to offer highly personalized premium rates based on real-time risk assessments. And with the evolution of machine learning and AI, telematics will be able to predict potential risks before they materialize. Such predictive insights can lead to timely interventions, reducing accidents and claims.

In essence, the future of telematics in fleet-insurance collaborations is not just about technology but about forging stronger, more informed partnerships that drive both industries towards a safer and more efficient future.

How is Jungo taking part in the telematic revolution?

AI video telematics is a game-changer for fleet insurance. It offers a data-driven approach that’s revolutionizing the industry. By harnessing the power of Jungo’s VuDrive’s AI video telematics system, insurers can achieve unprecedented levels of underwriting precision. By identifying risky behavior, AI video telematics helps prevent accidents, leading to better loss ratios for insurers. Furthermore, FNOL and FNOR processes are redefined, enabling faster, more accurate notifications and assessments, thus accelerating the claims process and enhancing customer satisfaction.

VuDrive’s AI video telematics refines fleet insurance pricing with detailed driver behavior analysis. This allows for tailor-made policies and streamlines claims with clear evidence. It benefits both fleets and insurers by promoting safety, efficiency, and customer satisfaction.

VuDrive includes real-time alerts for both driver and fleet manager, event recording, trend analysis, driver scoring, all accessible via the cloud-based fleet manager platform. VuDrive enables fleets to identify and improve risky drivers, and prevent future accidents. Learn more about how VuDrive.

Contact Jungo to learn how our AI dashcam is reducing road accidents caused by driver distraction, lowers insurance costs and saves lives!